Review of U.S.-Mexico-Canada trade two years under the ‘New NAFTA’

July 1, 2022, marked the second anniversary of the United States-Mexico-Canada Agreement (USMCA). The agreement that replaced the North American Free Trade Agreement (NAFTA) was built on the idea of retaining North America’s status as one of the most economically competitive regions in the world

by Mark Ludwikowski and Aristeo Lopez – Reuters

Many scholars and economists have opined that NAFTA boosted trade and investment flows in North America during its 26 years of existence. The agreement opened markets in trade and services within the region. It helped integrate industries such as the automotive sector. Despite these accomplishments, NAFTA was not free of critics concerned with losses of U.S. automotive jobs and the need for updated provisions.

In 2017 Canada, Mexico, and the United States decided the agreement needed to be refreshed and negotiated the USMCA (also known as the new NAFTA) under the same basic principles of free trade provided in NAFTA but modernizing and adjusting some components.

Now entering into its third year there is enough of a sample size to review how the USMCA has performed and evaluate certain aspects of the complex and dynamic trade relationships in North America under this agreement.

“The agreement is holding steady upon the foundations rebuilt from its predecessor NAFTA in supporting one of the most vibrant trading regions in the world”

Trade flows show a dynamic and growing region

Canada and Mexico remain the top trading partners to the United States with China not far behind. From NAFTA’s entry into force in 1994 to 2020, the year NAFTA was replaced by the USMCA, U.S. trade of goods with Mexico and Canada increased from $343.1 billion to $1 trillion, despite some setbacks. In 2009 and 2020, for instance, trade flows registered a considerable decrease due to the financial crisis and the COVID-19 pandemic, respectively.

Since the USMCA entered into force on July 1, 2020, trade has been consistent with that set by NAFTA. In 2021, trade flows in North America reached $1.3 trillion, and 2022 is on the same pace. From January to May 2022 trade in the region reached $642.6 billion, which compared with the same period in 2021 (i.e., $521.8 billion) represents a 23.15 percent increase. At this pace, it is likely that 2022 will exceed 2021’s benchmark.

Reuters Image

Source: U.S. Census BureauTrade in services has also thrived under NAFTA. For example, U.S. exports of services to Mexico (mainly travel, transportation, business, and financial services) increased from $14.7 billion in 1999 to $30.4 billion in 2021.

Likewise, trade of services between the United States and Canada has been higher. In 1999, the United States exported $23.3 billion worth of services to Canada (mainly travel, professional and management services, intellectual property, and educational services), and by 2021 exports increased to $56.1 billion.

The transition from NAFTA to the USMCA did not alter trade in goods and services in the region; trade in these areas is still healthy despite some global disruptions in supply chains caused by the pandemic.

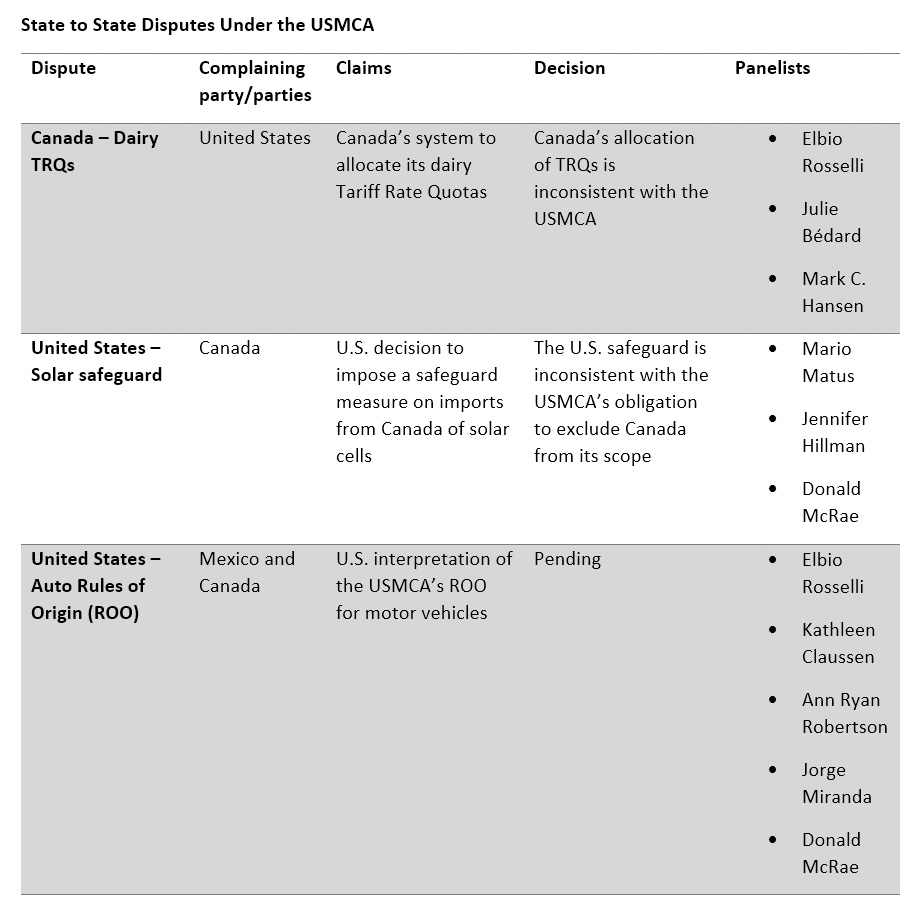

Trade disputes under the USMCA

It is not unusual for a dynamic and intense trade relationship to occasionally bounce into the rails as the USMCA has during the last two years. As with any contractual relationship, the key to keeping it intact is a reliable venue to resolve differences. NAFTA often witnessed disputes among the parties in different sectors. Even though the Parties were able to resolve some of them, sometimes it was necessary to settle the dispute through an impartial tribunal.

Ultimately, only three disagreements were settled through NAFTA’s dispute settlement mechanism during its first six years of existence. After Mexico and the United States disagreed on the access of Mexican sugar into the U.S. market under NAFTA in 2000, no subsequent panel was successfully established. The sugar dispute demonstrated that the mechanism lacked effective rules to appoint panelists in case of disagreement between the disputing parties and that it was easy for the responding party to block the process.

Not surprisingly, under the USMCA certain grievances still arise and during its first two years the new agreement’s dispute settlement mechanism has been successfully tested. The three countries learned the lessons of the past and cured the flaws. USMCA Chapter 31 includes a new dispute mechanism with revised rules which, among other things, maintains a roster of panelists and allows the disputing parties to appoint them if they are not able to agree, or a party refuses to participate in the process.

Reuters Image

So far, three panels have been established. Two of them have issued a final report finding USMCA breaches as shown in the table above. The third dispute was initiated in 2022 and is expected to conclude in November 2022.

Canada — Dairy TRQ. The United States brought the first dispute against Canada on May 25, 2021. The United States claimed that Canada’s practice of allocating Tariff Rate Quotas (TRQs) on dairy products (such as milk, cream, butter, and cheeses) was inconsistent with the USMCA. On Dec. 20, 2021, the Panel issued its final report finding that Canada’s allocation system breached the USMCA. In response, Canada made some adjustments, but the United States expressed its disagreement. Consequently, on May 25, 2022, the U.S. requested Canada consultations to address, for the second time, Canada’s restrictions on dairy products.

Under the agreement, the disputing Parties have 75 days to hold consultations. In case both countries fail to resolve the matter, the U.S. could request the establishment of a panel. Alternatively, the U.S. could impose sanctions on Canada under the 2021 final report. It remains to be seen what the next U.S. step will be after Aug. 8, 2022, when the 75-day consultation period expires.

United States — Solar Safeguard. Canada initiated the second USMCA dispute against the United States for the application of an emergency action (known as a “safeguard”) on solar photovoltaic products (such as solar cells and panels). In 2018, under the Trump administration, the U.S. imposed a 30% tariff on solar product imports from all countries, including Canada.

On Feb. 15, 2022, the panel found that the USMCA required the United States to exclude Canada under the case circumstances. As a result, on July 7, 2022, the United States and Canada announced an agreement to settle the dispute, excluding Canada from the safeguard.

United States — Auto Rules of Origin (ROO). Since the early days of the USMCA, Mexico and Canada have expressed disagreements over the U.S. interpretation of the USMCA ROOs for vehicles. ROOs are essential to ensure free trade in the region because they determine if a good qualifies as originating and thus if they benefit or not from duty-free treatment under the agreement.

In the case of the auto companies in North America, it is essential to have certainty about the application of ROOs to vehicles, which require thousands of parts, and different interpretations resulting in different applications is not desirable.

This dispute among the three countries continued in 2020 and 2021, until Mexico decided on Jan. 6, 2022, that it was time for a USMCA panel to settle the dispute. Canada joined Mexico as a complaining party, and the proceeding is still ongoing. A final report is expected in November 2022.

As the USMCA begins its third year, another dispute among the three countries appears to be heading to a panel. This time it is against Mexico. On July 20, 2022, the United States requested consultations with Mexico regarding Mexico’s energy policies. The U.S. contends that through various measures, Mexico favors its energy state-owned enterprises, PEMEX and CFE, over U.S. companies and U.S.-produced energy. On the same date, Canada filed its request for consultations concentrating on the electricity sector.

Unlike the previous disputes, this one is getting media attention because the U.S. and Canada are challenging the most important policy of Mexico’s current administration, and the conflict is being unusually politicized in Mexico. The President of Mexico, Andres Manuel Lopez Obrador, known as AMLO, has publicly stated that Mexico’s energy sector was not included in the USMCA and, thus, Mexico is not in breach of the agreement.

The reality is that in 2013, Mexico underwent major constitutional reforms to allow private investors to participate in Mexico’s energy sector, attracting investments in renewable energies and exploration and exploitation of hydrocarbons. Moreover, consistent with the new legal framework, Mexico negotiated the most important trade agreements in recent years (the Comprehensive and Progressive Agreement for Trans-Pacific Partnership -CPTPP-, Mexico- European Union Free Trade Agreement, and the USMCA), incorporating the 2013 energy reform and the access it granted to private investments.

However, in 2018 AMLO won the presidential election in Mexico, promising to regain control of the oil, gas, and electricity sectors. To achieve that objective, AMLO has adopted policies and changed laws that Mexico’s two main trade partners are now contesting. The United States and Canada have long expressed concerns about AMLO’s policies in the energy sector to no avail and finally the issue seems to be heading to a USMCA dispute resolution panel.

Over its first two years, the USMCA has certainly been tested. But despite these challenges, the agreement is holding steady upon the foundations rebuilt from its predecessor NAFTA in supporting one of the most vibrant trading regions in the world. In doing so, it has maintained the promise of free and fair trade in the region.