Food manufacturers must invest in innovative agriculture to meet COP26’s deforestation goal

COP26’s ambitious pledge to end deforestation by 2030 presents major challenges to fast-moving consumer goods (FMCG) producers

The leading data and analytics company notes that, as global food commodities such as meat, palm oil, soya and cocoa are currently entwined with significant land usage and deforestation, hardline policies and increased investment in research and development (R&D) will be vital in providing industry players and stakeholders with reassurance, clarity, and practical solutions to reach the goal.

“Agroforestry and afforestation are also crucial ways in which brands can support farmers in transforming their operations to protect and integrate local biodiversity“

“Without tangible and clear direction on how a global policy like this will be enforced across national borders, the worry is that it simply won’t be,” said Carmen Bryan, Consumer Analyst at GlobalData. “Technologies such as blockchain or artificial intelligence (AI) could allow brands to better monitor their actions in protected areas and provide more transparency to governing bodies.”

In May this year, Lindt & Sprüngli hit a sustainable milestone, after fully realising 100% transparency of its cocoa production from bean-to-bar. Similarly, Gaiachain and IUCN are developing a blockchain solution for forest landscape restoration (FLR) that will provide financial incentive to farmers in exchange for FLR activities verified by facilitators. These are promising developments, particularly as consumer interest in production methods and techniques is rising.

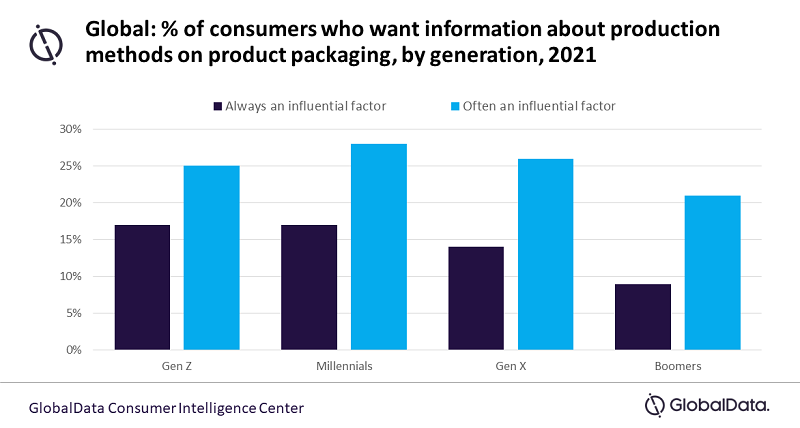

According to GlobalData’s latest survey, two in five (40%) global consumers want to know about production methods in an accessible way (via packaging); this is relatively consistent across generations demonstrating mass appeal. Another 69% find ‘sourced sustainably’ claims to be extremely or quite important. There is a clear impetus from consumers for brands to invest in sustainable technology and reinvent modern agriculture.

“Agroforestry and afforestation are also crucial ways in which brands can support farmers in transforming their operations to protect and integrate local biodiversity,” Bryan added. “Many farmers lack the resources or knowhow to implement wide-scale changes, therefore, brand collaboration from mega players such as Nestlé or Unilever with local and indigenous communities will be key to ensuring COP26’s commitment is met. On the other hand, innovations in vertical farming and cultured meat allows brands to localise supply and cut out mass land usage altogether.”

Changes to consumer buying behavior are also needed; many of these commodities are imported as consumer goods to western nations from developing markets. With 56% of the global population stating that they are more loyal to brands that support environmental causes, the groundwork has already been laid.

“There is a misconception that we can consume indefinitely, while the economy continues to grow,” Bryan adds. “To meet increasing demand, it is necessary that attitudes towards consumerism change. ‘Refill and reuse’ trends show promise in shaping a more circular economy and forgoing a ‘buy-it-throw-it’ mentality. Ultimately, though, food manufacturers need to invest in sustainable farming and production techniques that will provide long-term stability.”

Survey data is taken from GlobalData’s Q3 Global Consumer Survey, September 2021