Alberta’s Massive Cattle Backlog is Easing But Trepidation Lingers

A massive backlog of cattle in the Alberta beef industry is now easing, as large meat processors have ramped up production to pre-pandemic levels

by Tony Seskus – CBC News

A buildup of tens of thousands of animals formed this spring after outbreaks of COVID-19 among meat plant workers resulted in slowdowns or temporary closures of North American facilities, including in Alberta.

Now, there’s hope — if all goes well — the backlog could be cleared by sometime in October.

“The term I’m using is cautiously optimistic,” said Janice Tranberg, president of the Alberta Cattle Feeders’ Association, who noted the backlog has fallen from around 130,000 animals to closer to 110,000.

“We need them to be operating at over capacity to help us get through that backlog. So if they have to slow down or shut down again — another wave — it keeps me up at night”

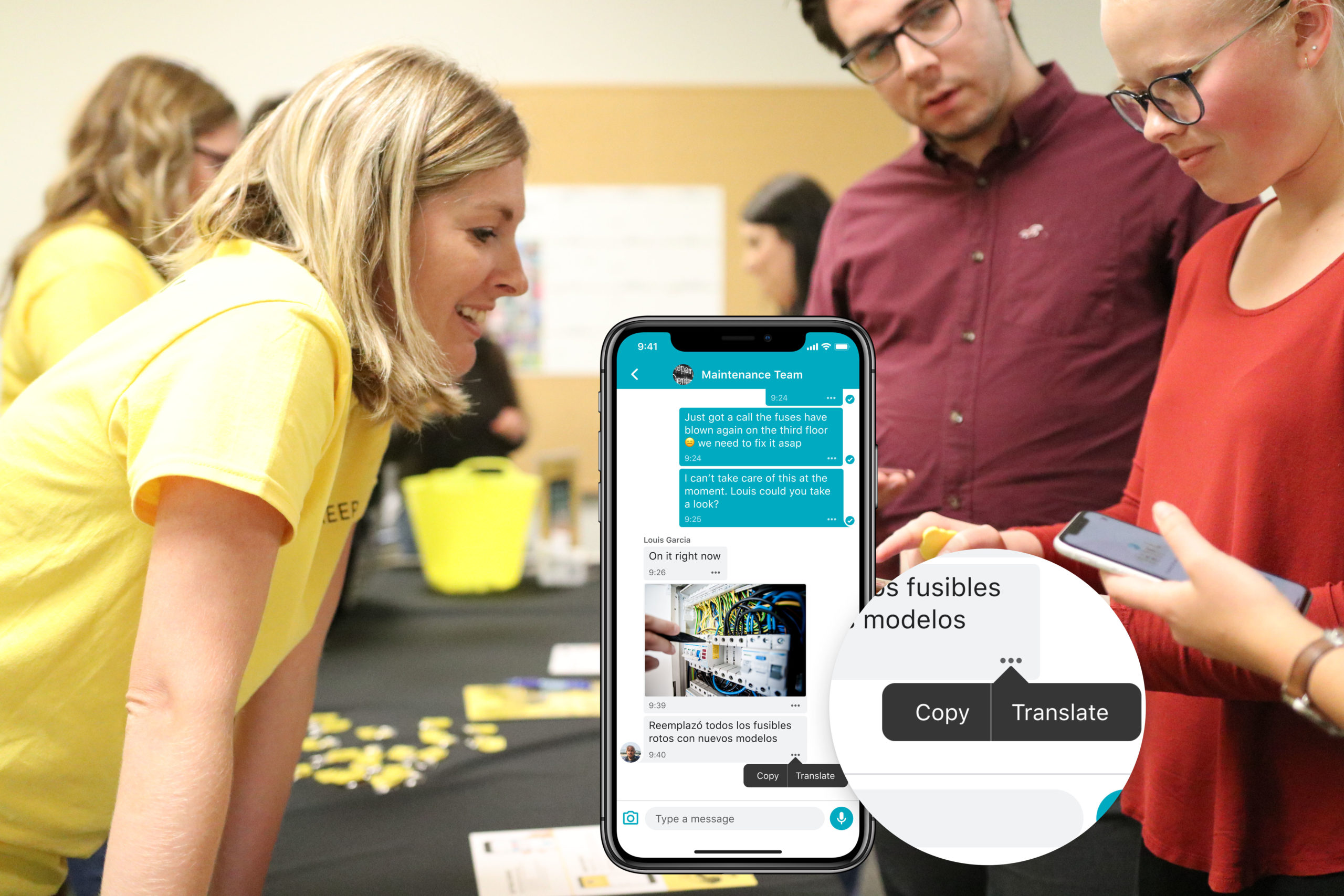

As meat processors in Alberta have ramped up production to more normal levels, a large backlog of cattle in the province is starting to shrink. (Reuters)

“If the processing plants continue in the route they are, and if other sectors of the value chain aren’t negatively impacted, then hopefully by fall we will be caught up.”

That would be good news for a cattle industry which sees its busiest time in the fall.

But uncertainty remains. The pandemic still clouds the outlook for the industry.

While there is confidence among the sector that processors have made the necessary preparations should a second wave of COVID-19 emerge this fall, even the thought of another temporary plant shutdown is enough to sparkl unease.

“That’s what keeps me up at night,” said Kelly Smith-Fraser, who ranches with her family near Pine Lake and is chair of the Alberta Beef Producers.

“Another plant closure would be incredibly scary to our industry. We’ve been needing them to be operating at full capacity.”

It’s been a difficult stretch for the sector since the disruptions of the pandemic, shaking up what looked like a fairly healthy market at the beginning of the year.

Food supply chains were rattled as demand from the restaurant sector crumbled overnight amid pandemic restrictions. The meat sector was also sideswiped by the temporary shuttering of processing facilities in Canada and the United States.

In Alberta, this included a two-week closure of the Cargill beef processing plant near High River, where 900-plus employees tested positive for the virus. The JBS plant near Brooks scaled back production for a time, as more than 600 workers contracted COVID-19.

Three workers from the Alberta facilities died, as did the father of a worker.

The disruption to processing in North America helped push meat prices higher at grocery stores, but it had the opposite effect down the supply chain, where a backlog of cattle emerged.

It “significantly” changed market fundamentals in Canada and the U.S, said Craig Klemmer, principal agricultural economist at Farm Credit Canada (FCC).

The situation hurt cattle prices for feedlot operators with animals ready to go for slaughter.

“Generally, on a good year, when we’re talking strong profits in the industry, we’re looking at profits around $50 to $100 dollars per head,” Klemmer said.

“When we’re seeing losses — $200, $300, $400 per head, depending on time period — those are quite significant losses and just kind of speak to some of the challenges the cattle industry has been experiencing.”

He expects the backlog to create challenges for the cattle industry for the remainder of 2020.

Clearing cattle backlog ‘important’

The FCC’s July forecast for the second half of the year expects prices for Alberta fed cattle (those going for processing) will be 12 per cent lower than the five-year average. Feeder steers (those headed to feedlots) will be down nine per cent.

“The sooner we can get through this backlog … it is going to be important,” Klemmer said.

Ranchers and feedlot operators are encouraged by the strides they see processors making.

In an email to CBC News last week, a Cargill spokesman said the company’s facilities across Canada are operating near full capacity. Similarly, a representative for JBS said its Brooks operations have normalized and production levels have returned to “historical norms.”

“Out of an abundance of caution, we have maintained our COVID-19 preventive measures and controls and will continue to do so until a long-term solution to the pandemic is identified,” said JBS spokesman Cameron Bruett in an email.

Dennis Laycraft, executive vice-president of the Canadian Cattlemen’s Association, said having large processors running at full capacity has made a ‘huge difference.’ (Radio-Canada)

Dennis Laycraft, executive vice-president of the Canadian Cattlemen’s Association, said having the large processors running at full capacity has made a “huge difference.”

“And I think you’re obviously seeing that in retail stores — you’re starting to see a lot more beef being featured,” said Laycraft.

Watching the U.S market

He said as more normal conditions resume at processors, he anticipates export sales will also recover. Still, what happens in the U.S. market later in 2020 will also likely affect the Canadian market.

“Our prices arbitrage very closely because of the high degree of integration between our two markets,” Laycraft said. “So we’re really watching what’s happening there as well.”

Another concern in the cattle industry is what could happen if a second wave of COVID-19 arrives this fall — again rattling the meat supply chain. Chief among those concerns is the possibility of a large processor again closing temporarily or limiting production.

The fall is particularly important to ranchers because that’s when they sell their cattle at auction or directly to feedlots. Another large backlog during the “fall run” could sink prices or force ranchers to take on the substantial expense of holding onto their animals longer.

“We need them to be operating at over capacity to help us get through that backlog,” said rancher Smith-Fraser of the Alberta Beef Producers. “And so if they have to slow down or shut down again — another wave — it keeps me up at night, for sure.”

Still, she believes precautions are being taken.

“If there’s a strong second wave, I have confidence that the plants are prepared,” she said.

Smith-Fraser said the general uncertainty around the market had the association talking to its members about price insurance, which would guarantee a bottom price for their calves.

She said while there are good indications there is going to be a strong market in the fall, there are others that point in the other direction as well.

“We don’t have the crystal ball to tell us what these markets are going to look like,” she said.

CBC News