FCC’s 2020 Red Meat Outlook Update: Expect Livestock Prices to Improve

FCC Ag Economics will update its projections about profitability across three Canadian agriculture sectors (red meat, dairy and grains, oilseeds and pulses) throughout October

by Leigh Anderson – Farm Credit Canada (FCC)

We’ll describe what has happened in 2020 to-date and what to monitor over the next six months.

In our February 2020 Red Meat Outlook, we identified five factors likely to impact profitability:

African Swine Fever’s (ASF) disruption of livestock and meat markets Trade tensions’ influence on agri-food markets Robust global and domestic red meat demand Growth in U.S. beef and pork production The global economic impact of coronavirus

“While we are projecting prices to improve over the next six months, a second wave of COVID-19 is emerging”

Recap of the first nine monthsThe first nine months of 2020 have been a rollercoaster ride for both the pork and beef sectors. The year started with great optimism due to reduced red meat supplies stemming from ASF. Optimism was cut short by the COVID-19 pandemic. Outbreaks at processing plants significantly reduced capacity, resulting in a large backlog of animals, approximately 130,000 head of cattle and 150,000 hogs by May 2020. The disruption led declining farm-gate prices through the first half of 2020 and higher prices at grocery stores.

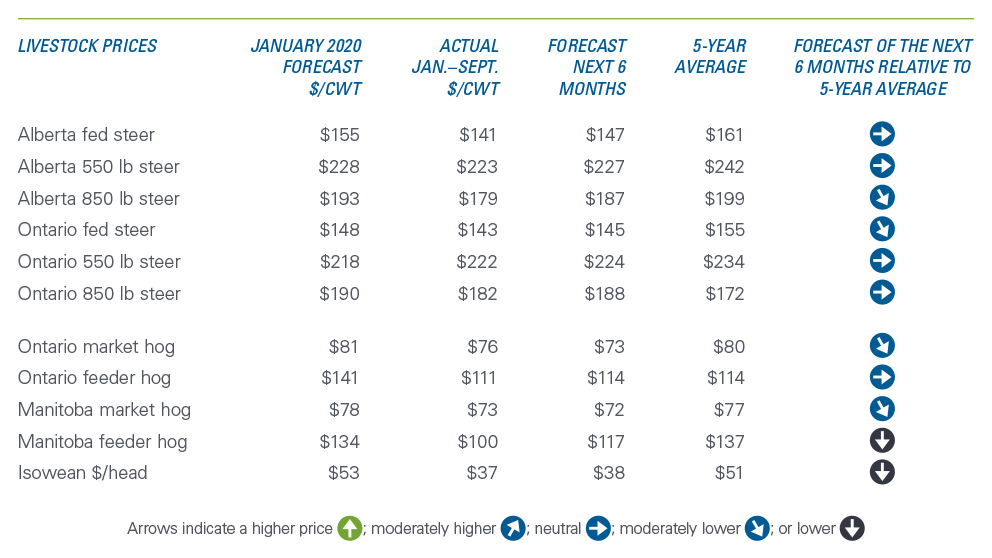

Significant reductions in the backlog of animals and strong demand for proteins have driven the rebound in farm-gate prices. Yet, average livestock prices through the first nine months remain below our January forecast (Table 1).

Table 1: Improved livestock prices expected in the next 6 monthsSources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations

Trends to monitor in the next six monthsOur revised price forecasts for Q4 of 2020 and Q1 of 2021 indicate prices will improve for most livestock categories. Prices are projected to be within 10% of their 5-year average price, except for Manitoba isowean and feeder hogs. This would be a large improvement from our July 2020 update. There are several reasons why prices are likely to improve over the next 6 months.

1. U.S. productionThe pandemic led to reductions in overall U.S. production estimates. The latest USDA numbers indicate that U.S. beef production could decline -0.4% in 2020, compared to a 1.2% growth projection in January. U.S. pork production is projected to increase 2.2% in 2020, down from the 4.5% growth estimate at the beginning of the year.

2. ASF and global pork suppliesOur January 2020 prediction that ASF would be the story to watch in 2020 is playing out. While China has begun to rebuild its hog herd, reports suggest China has now culled 100 million hogs and essentially depleted its pork storage stocks. Furthermore, strong export demand to China has also reduced U.S. cold storage stocks of pork, which will support North American hog and cattle prices.

The presence of ASF was also recently reported in Germany. Several Asian countries, including China, South Korea and Japan, have placed a ban on German pork imports. While the ban is temporary, expect increased North American pork exports to China as Germany has been the third-largest supplier of pork to China. Lean hog futures have risen between 5%-13% following its discovery.

3. Re-opening of economiesWhile we are projecting prices to improve over the next six months, a second wave of COVID-19 is emerging. COVID-19 cases can slow the re-opening of the Canadian economy, limit foodservice sales disrupting agri-food supply chains.

The September OECD economic projections indicate a swift recovery after the pandemic’s initial shock, which has lost momentum since then. World GDP is expected to contract by 4.5% in 2020 and rebound 5.0% in 2021. The economic recovery for top destinations of Canadian red meat follows a different pattern. OECD forecasts suggest a slower recovery in the U.S., Japan, Mexico and South Korea. China is a notable exception: growth is expected to dip to 1.8% in 2020 from the 6.5% annual growth observed in recent years. But it could rebound by 8.0% in 2021.

China’s overall impact on global agricultural markets cannot be understated – a faster economic recovery should benefit the Canadian red meat sector.

Leigh Anderson joined FCC in 2015 as a Senior Agricultural Economist, specializing in monitoring and analyzing FCC’s portfolio, industry health, and providing industry risk analysis.