Why Evolving Food Preferences Are Showing More Demand For Protein

Canadian per capita beef consumption has been declining over the long-term; yet Canadian beef demand is still strong. Consumption trends generally evolve because of preferences, but they also are function of prices and income

by Leigh Anderson – Farm Credit Canada (FCC)

The annual growth rate on the market size for plant-based protein in Canada was 4.8% in 2017, expected to grow annually by 5.6% by 2022.

The global protein market from field peas is projected to grow by 11.9% to US$359.4 million in 2022 from its estimated value of US$191.7 million in 2017.

Canada is expected to mirror this global growth, reaching US$31.6 million by 2022 creating additional value add for Canadian pulse growers. However, economic research on consumer market size and preferences is in its infancy.

“Shifting demographics and health considerations are broadening our palate for proteins and higher quality food. These trends matter for Canadian agriculture, in both the domestic and export markets”

For example, two studies (one from the University of Saskatchewan and a joint study from Wageningen University, Michigan State and Purdue) found that a majority of U.S. consumers prefer beef burgers when alternative protein prices were the identical. Both also suggest the market share for plant-based burgers is between 15%-20%.

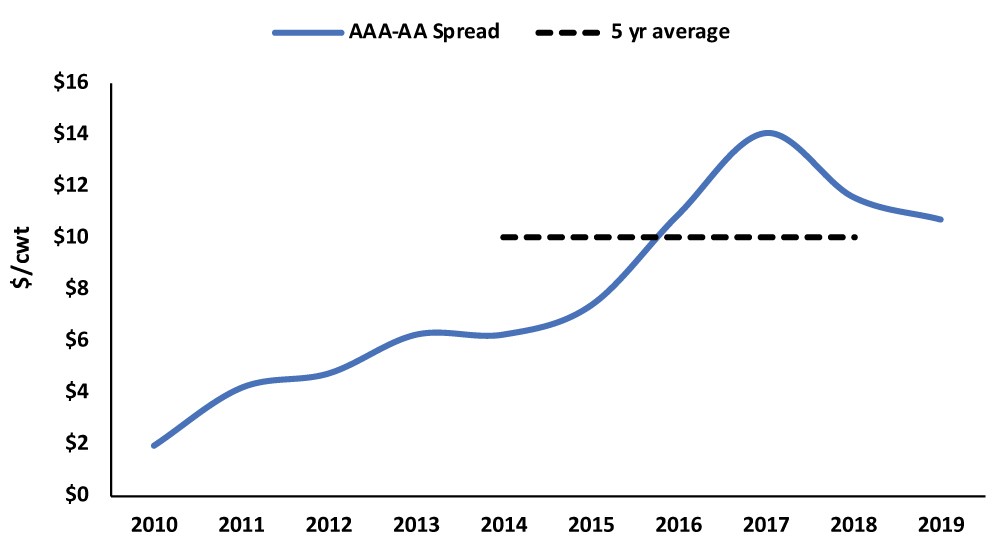

This only scratches the surface when it comes to actual food options are available to consumers. Prices matter and are a reliable signal of desirability. There is evidence of a stronger demand for higher quality beef. The spread between AAA and AA beef cutout values has been increasing in the last decade (Figure 1).

Source: CanFax

Relative prices between animal and plant-based proteins will influence consumers’ purchases. There appears to be room for a diverse supply of proteins as growth is found in many segments of the two protein categories.

Growth in emerging markets

The make-up of the domestic demand for animal proteins determines what Canadian businesses have to offer in export markets. Outside of North America, particularly in Asia and other emerging markets, meat consumption continues to grow.The 2019-2028 OECD Agricultural Outlook projects over the next decade that global meat consumption will grow at an annual rate of 1.10%, a lower pace than the previous decade of 1.74%. However, emerging countries are projected to have a higher growth rate of 1.41% than developed countries at 0.59% (including Canada). This is especially true in Asia where population growth and rising incomes result in increased per capita consumption.

Opportunities for Canada will be plentiful as Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTTPP) countries are projected to increase imports (e.g. Vietnam 3.54%, Malaysia 2.70%) to meet growing consumption.

Growth in protein consumption is a bright light in food markets amid current trade tensions. Amid the competition for the share of consumers food dollars, businesses need to pay attention to the competitiveness of their products (price vs quality) and the evolution of food preferences.

Leigh Anderson joined FCC in 2015 as a Senior Agricultural Economist, specializing in monitoring and analyzing FCC’s portfolio, industry health, and providing industry risk analysis. Prior to FCC, he worked in the policy branch of the Saskatchewan Ministry of Agriculture. He holds a Master of Agricultural Economics degree from the University of Saskatchewan.

Our September 2025 Issue

In our September 2025 issue, Beef Advocacy Canada relaunches new platform, U.S. shuts the door on small exporters, The future of meat, John Deere tariff warning, Shrugging off high beef prices, Geopolitics and Bird Flu, The reshaped meat processing industry, Rethinking Ag trade, and much more!