FCC Report: Global shipping bottlenecks and Canadian agriculture

Nobody likes to take a major detour on their summer road trip or hail a taxi during rush hour, but this is akin to what’s going on in the global shipping sector

by Leigh Anderson – Farm Credit Canada (FCC)

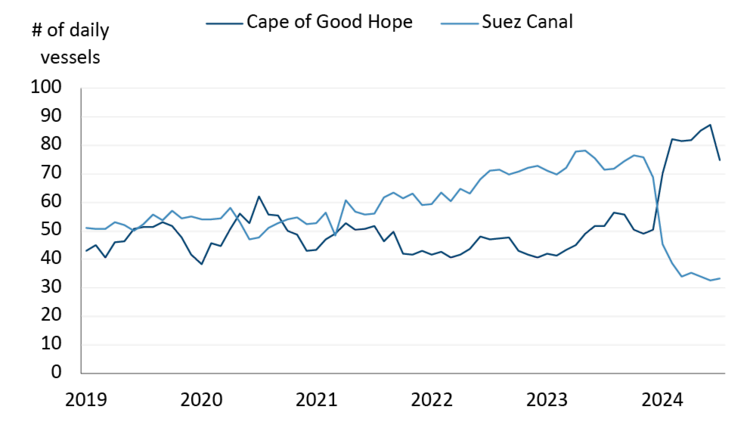

Figure 1: Red Sea conflict impacting global shipping routes

Sources: UN Global Platform, IMF PortWatch

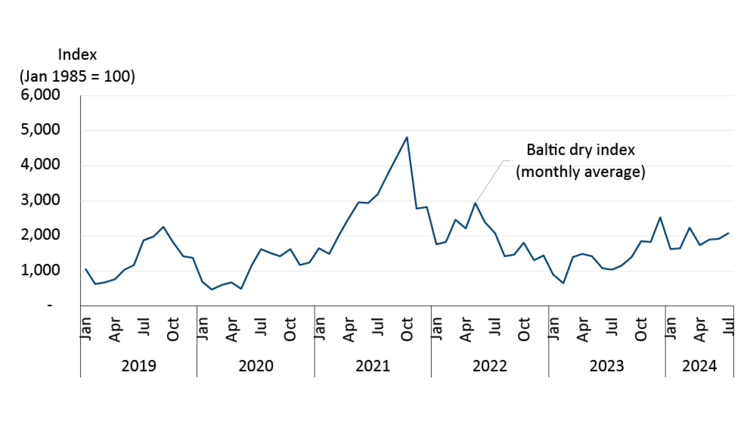

Those transportation bottlenecks have pushed up ocean freight rates over the last year. The Baltic dry index, a global measure of dry bulk freight prices, has doubled over the past year (Figure 2) while the world container index has more than tripled. Global freight rates in recent years have been volatile. While freight costs have risen in 2024, prices remain lower than in 2021 when shipping costs reached record levels. Most of Canada’s exports head to destinations that do not require the Panama or Suez canals, but higher global freight rates do impact Canadian agricultural and agri-food producers and exporters. The consequences of increasing freight rates go beyond those involved in actually moving goods; higher shipping rates could feed into higher consumer prices and potentially disrupt the steady progress being made on tackling inflation.

Figure 2: Baltic dry index has trended higher in the last year

Sources: Bloomberg, FCC calculations

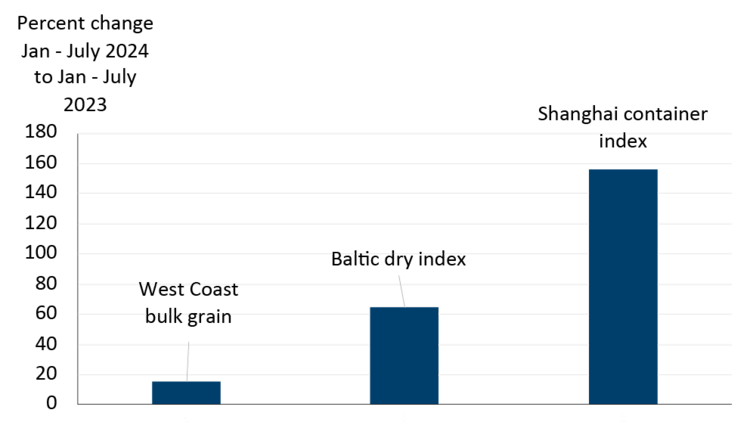

The discrepancy in some freight rates depends on the commodity hauled (bulk versus container) and the destination. Outbound containers from Asia are facing higher rates than inbound goods. The North America to Asia route is traditionally cheaper but in recent months those prices have also started to rise. Canadian freight rates out of the west Coast remain favourable meaning the impact to Canadian agriculture and food has so far been minimal (Figure 3). West coast grain freight rates have averaged approximately USD $32 per tonne in 2024, up from USD $28 per tonne during the same period in 2023. For comparisons the Shanghai container index has risen from an average approximate value of USD $980 to USD $2,500 per twenty-foot equivalent (TEU) in this year.

Figure 3: Foreign freight rates vs West coast freight rates

Sources: USDA, Bloomberg, Trading Economics, FCC calculations

Positive developments on the horizon

Red Sea detours around Africa are not expected to end anytime soon. However, there are reasons to be optimistic about easing global port congestions over the coming weeks. For starters, global shipping companies and their customers are adapting scheduling and arrivals to the new operating environment. To catch up on schedules some large ships were redirected to larger Asian ports to unload their shipments which were then reloaded on smaller ships to continue to final destinations. While this may have caused short term disruptions at Asian ports, the strategy is likely to improve overall supply chain performance going forward.

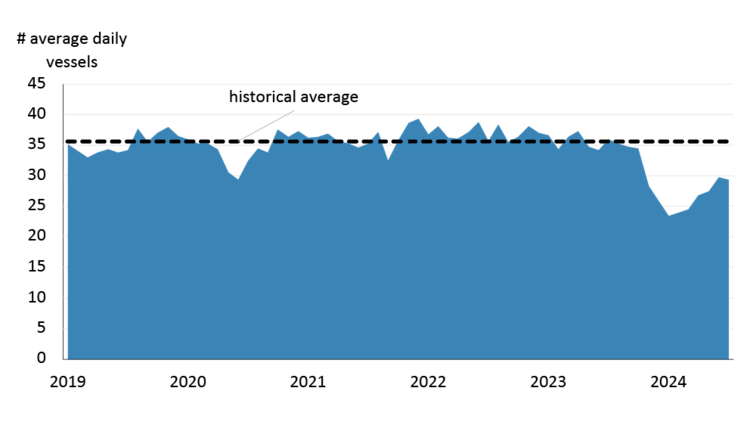

Adding to the good news is the fact that water levels at the Panama Canal are reportedly returning to normal faster than expected, courtesy of recent rainfall in the region. As a result, daily transits are now increasing, and are likely to hit 35 next month which is near the historical average of 36 (Figure 4).

Figure 4: Panama Canal daily transits trending towards normal levels

Sources: UN Global Platform, IMF PortWatch

Fuel prices remain a wildcard

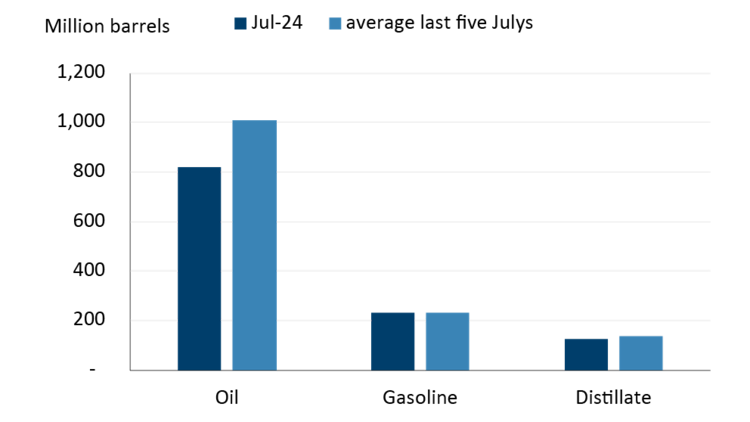

While things seem to be moving in the right direction with regards to freight costs, it’s worth pointing out that there’s still a lot of uncertainty. Fuel prices remain a wildcard considering they tend to respond to changes in oil prices and also to changes in inventory, which can be volatile. These inventories reflect the balance between supply and demand. For instance, this month’s U.S. crude oil inventories are down 19% relative to the last five Julys. Gasoline inventories are within historical levels while distillate inventories are approximately 9% lower (Figure 5). Fuel price reaction to changes in inventory also reflect how they compare to market expectations.

Figure 5. U.S. crude oil and fuel July inventory relative to the last five July’s

Sources: U.S. EIA, FCC calculations

The lower-than-average inventories could be supportive of oil prices over the near term, although we’re not anticipating a surge anytime soon amid a still-dull global economic outlook. Indeed, we are expecting oil prices to average slightly above USD $80 per barrel in 2025, not far from current levels. That’s not to say there won’t be any volatility. Oil prices will fluctuate depending on news that impacts supply or demand (e.g. hurricane season, escalation of conflict on the Red Sea, and U.S. economic trends) but any volatility is expected to be short lived with prices reverting to our projected trend over the forecast period.

Bottom line

Global shipping bottlenecks appear to be easing, which suggests that ocean freight costs may be heading down over the coming weeks. Fuel costs, however, remain a wildcard, and could potentially derail this downtrend, although at this point we’re not expecting a major surge amid a weak global economic outlook. Perhaps the most significant risk related to transportation cost for Canadian agriculture and food is the possibility of strike action that could potentially curb activities at railways and ports. Contingency planning for Canadian exporters remains important to minimize any related disruptions.

Leigh Anderson is a Senior Economist at FCC with experience in agricultural markets and risk.