FCC Report: Economic headwinds for the agricultural equipment market

The Canadian agricultural equipment manufacturing sector experienced softer sales through the first quarter this year

By Leigh Anderson – Farm Credit Canada (FCC)

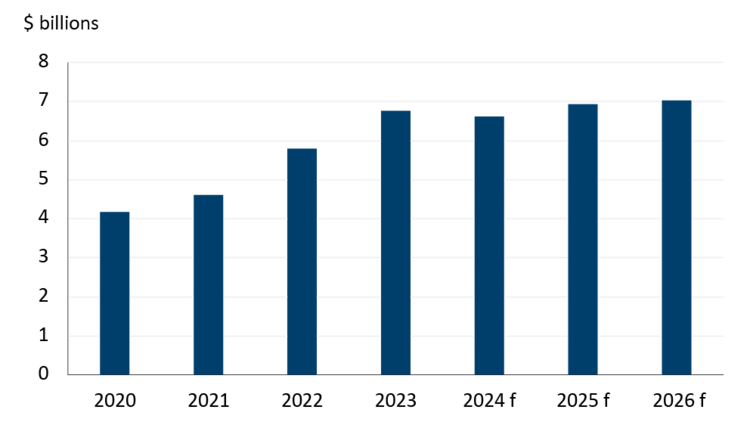

Figure 1: Canadian agricultural equipment manufacturing sales

Sources: Statistics Canada, FCC calculations

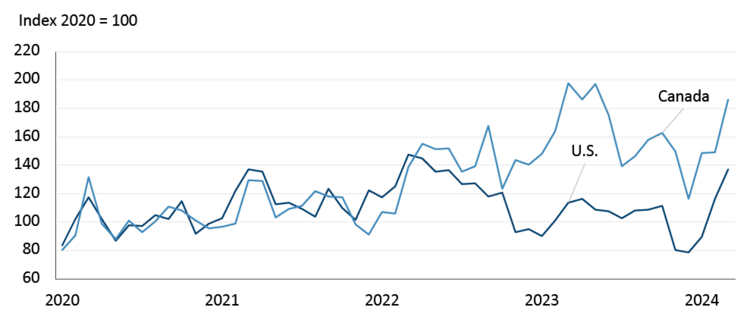

A slowdown in Canadian sales this year was always in the cards. For starters, large U.S. agricultural equipment manufacturers had already begun to curtail production in response to declining demand. It was just a matter of time before the same happened north of the border as well. Also, sales trends between Canada and the U.S diverged following the pandemic (Figure 2), with 2023 sales surging this side of the border after supply chain issues were sorted out. After such a solid year, a slowdown was inevitable.

Figure 2 : Canadian and U.S agriculture equipment manufacturing sales measured in Canadian dollars

Sources: Statistics Canada, U.S. Federal Reserve Bank of St. Louis

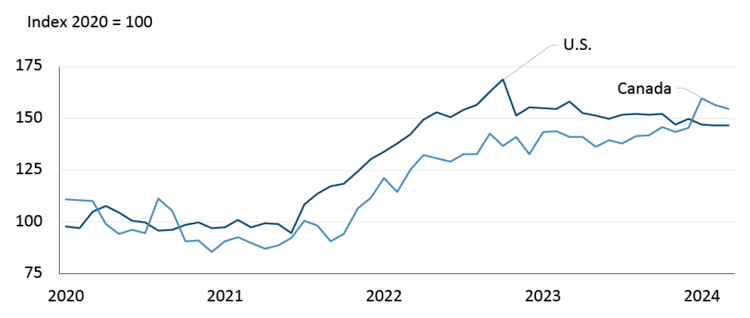

Higher equipment prices, as opposed to volume, are largely responsible for U.S. agriculture manufacturing sales growing 20% in the first quarter of the year. However, the large U.S. agricultural manufactures are forecasting approximately 10 to 15% declines in large agricultural equipment sales this year and are accordingly cutting production to keep inventories in line with demand. While U.S. manufacturing inventory values have declined slightly so far this year, they are expected to remain elevated (Figure 3). A similar trend is occurring here as slowing Canadian agricultural manufacturing sales and rising equipment prices have resulted in rising inventories.

Figure 3: North American equipment manufacturing inventory values remain historically high

Sources: Statistics Canada, U.S. Federal Reserve Bank of St. Louis

A positive story amongst the large U.S. manufacturers is that the above-mentioned curtailment in production has allowed them to focus resources on producing equipment that is in high demand (e.g. high clearance sprayers) and reducing the time from order to customer delivery. Canadian manufacturers may be in a similar situation as most are small niche manufacturers.

Other factors to consider

Canadian dollar and interest rates

Production costs

The Bank of Canada cut the overnight rate in June to 4.75% and signaled additional cuts ahead. If, as expected, there are another 50 basis points by year-end, the interest rate spread with the US could widen further, weighing on the Canadian dollar in the process. A lower dollar would help export competitiveness, but it also means higher import costs related to raw materials. This period of currency weakness isn’t expected to last, as the US Federal Reserve is also set to cut its own interest rate later this year, which will pressure the US dollar.

Manufacturing outlook: labour and raw material costs

Much like farmers focus on their per acre equipment costs, equipment manufacturers also pay close attention to their costs. Labour and raw materials account for approximately 20% and 65% of total expenses, respectively. Growth in wages paid by equipment manufacturers has trended higher during the first three months of the year with an average growth rate of 5.7%. Wage growth is expected to moderate as the Canadian economy slows, along with potentially increasing the supply of qualified workers available to be hired by for manufacturers.

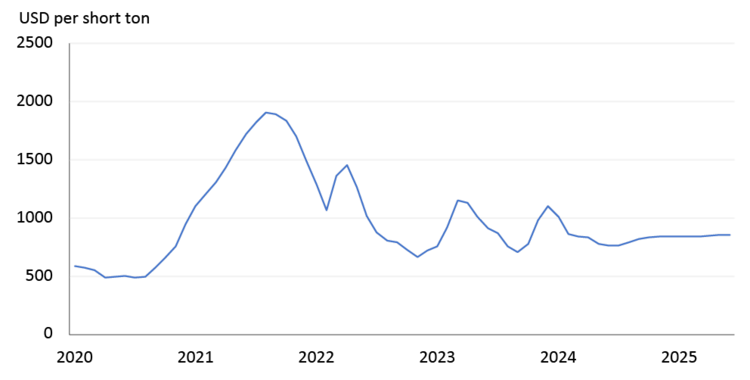

Various prefabricated metal and steel products are the main raw materials. The U.S. Midwest steel futures contract, which is used as a proxy for costs, is currently trading sideways (Figure 4). Slowing global demand and potential oversupply in places like China could result in prices trending lower.

Figure 4: U.S. Midwest steel futures trending sideways

Sources: Barchart, FCC calculations

Steel tariffs: will agriculture face retaliation?

There is uncertainty following the U.S. announcing it will re-impose tariffs (up to 25%) on certain Chinese steel and aluminum products on August 1, 2024. History can give us clues on what might unfold with U.S. steel tariffs.

The U.S. imposed numerous steel and aluminum trade tariffs in 2018 with several trading partners, including Canada and China. These trade barriers increased production costs as tariffs were applied each time a product crossed the border. In equipment manufacturing certain components may cross the border multiple times prior to ending up in agriculture equipment. Further impacting the agriculture economy that year, agricultural markets were caught in the crossfire of the trade tensions. U.S. tariffs on steel and aluminum imports was met by retaliation on U.S. exports of agriculture and food products. China’s 25% tariff on U.S. soybeans weakened the demand for U.S. soybeans, which resulted in price declines and lost revenues for Canadian farmers.

As we continue to approach the 2024 U.S. elections, expect to see growing U.S. protectionism, regardless of any potential changes in U.S. administration leadership.

Canadian manufacturers must also think of the possibility of falling demand for raw materials and resulting downward price pressures prices. On the flipside, tariffs could lead to rising costs. Evaluating raw material needs and planning cost-effective purchases based upon various scenarios for 2025 and 2026 will be imperative to support profitability.

Bottom line

Tighter profitability has farms placing a greater emphasis on their per acre equipment costs, reducing demand for equipment. Manufacturing equipment sales are projected to experience slow growth in the coming years. Global trade tensions and the evolution of agricultural commodity prices are key drivers of the trends in the demand for farm equipment.

Leigh Anderson is a Senior Economist at FCC with experience in agricultural markets and risk