Meat product manufacturing: 2024 FCC Food and Beverage Report

The following information is from the 2024 FCC Food and Beverage Report, which highlights the opportunities and challenges for Canadian food manufacturers by sector. To get the big picture read the full report.

Farm Credit Canada (FCC)

Too much and little – livestock supply issues creating difficulties

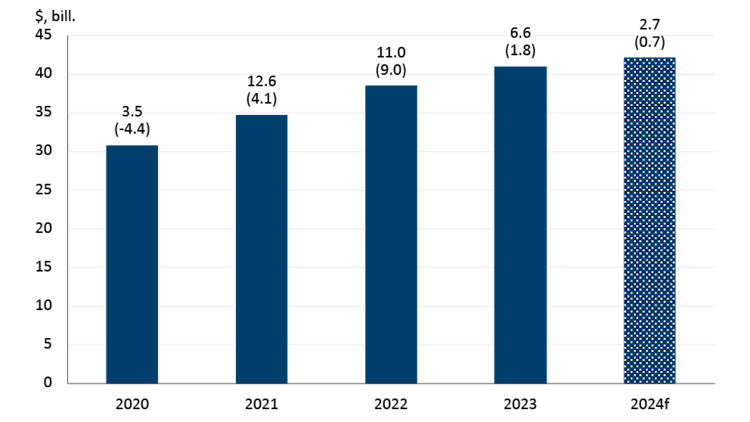

After double-digit sales growth in 2021 and 2022, meat product sales slowed in 2023. FCC Economics forecasts 2024 sales to grow (2.7%), with volumes also modestly up YoY (0.7%).

Figure 1: Meat product sales, volume growth is expected to slow in 2024

Total sales (in $, billions) are on the y-axis. The top number above each bar is the year-over-year growth in sales measured in dollars. The bottom number above each bar (in parentheses) is the year-over-year growth in volume sold. Volumes are reported sales deflated by a price index (January 2020 = 100).

“2024 margins will improve from 2023, but the results will differ greatly depending on the type of meat and region”The meat manufacturing sector comprises establishments engaged in slaughtering beef cattle, hogs, and poultry and preparing processed meats and meat by-products. Given the sector’s diversity, there is much to consider when examining the numbers in aggregate.

The pork processing sector has been under duress for the last three years. The pork sector ramped up 2018 production to meet export demand from China due to the African Swine Fever outbreak in that country; when Chinese production returned to normal, that revenue stream dried up. Multiple pork plants have closed in the last 18 months and capacity has been reduced at others, particularly in Eastern Canada. In 2023, the number of hogs slaughtered in Eastern Canada was down 1.6% (in Western Canada, slaughter numbers were up 3.7%).

The story is quite different for beef processors. After several years of drought, the U.S. beef herd size ended in 2023 at the lowest level in 60 years, and the Canadian herd size at the lowest level in 35 years. This resulted in cattle prices closing 29% higher than at the beginning of the year. Beef demand and consumption have remained robust despite high prices, though both eased in the latter half of 2023.

Poultry remains the most popular meat protein choice, but the poultry processing sector faces challenges. Recent farmgate increases will pressure manufacturers’ raw input costs. At the same time, frozen chicken stocks are at a record high. Chicken demand needs to pick up to absorb the increased 2023 production, higher imports and current high levels of stocks.

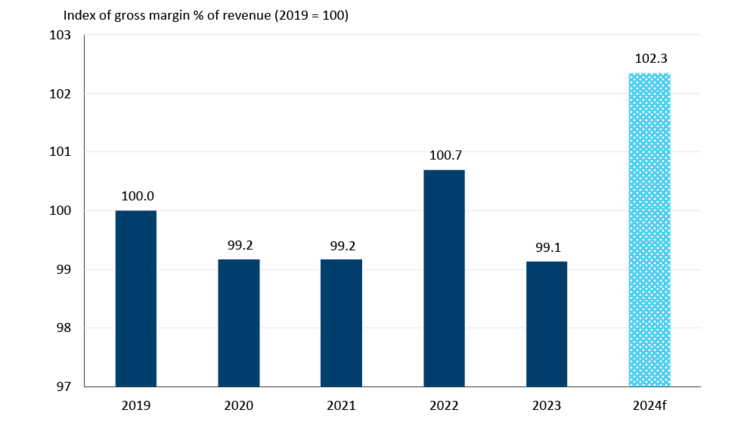

In aggregate, 2024 margins will improve from 2023 (Figure 2), but the results will differ greatly depending on the type of meat and region. Pork processing margins will improve, but relative to a difficult 2023. Beef processors’ margins will be positive, but competition for live cattle will remain fierce for the foreseeable future given the small North American herd size. Poultry processors must deal with the high levels of frozen inventory and flatlining demand.

Figure 2: Meat product manufacturing margins to improve in 2024

Sources: FCC Economics, Statistics Canada

The domestic pork sales outlook is positive given pork’s relative price advantage at the supermarket. Pork exports will struggle in 2024 as the industry continues to adjust to a glut of hogs and reduced processing capacity, but the low Canadian dollar is providing some support. Due to high retail prices, domestic beef demand faces challenges but has been surprisingly resilient to date. Low cattle inventories will keep the availability of cattle scarce and prices high. Beef exports will continue to benefit from a strong U.S. economy and a low Canadian dollar. Conversely, a low Canadian dollar makes chicken imports more expensive. In 2023, the quantity of chicken and turkey imports was up 8.4%, but the value of these imports fell by 3.0%, indicating that Canada imported more – but cheaper – poultry meat in 2023. This trend will be monitored in 2024 to balance domestic production with consumption.

FCC Economics spotlight: A detailed look at meat export markets

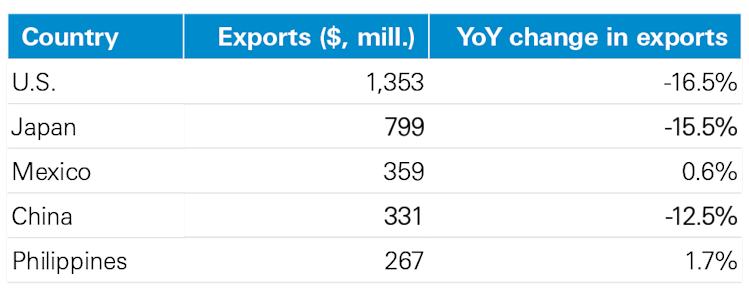

Canadian beef exports were strong last year, up 9.4%. Exports to the U.S. were up 18.5%, as the weaker Canadian dollar allowed Canadian beef products to maintain a competitive advantage. Beef demand remained robust amid a strong U.S. economy, even in the face of high retail prices. Also noteworthy is that in 2023, Mexico’s exports surged, but Japan and Korea’s exports slumped (Table 1).

Table 1: Top five beef export markets in 2023

Source: CIMT Database

Pork exports were down -7.0% in 2023. The U.S. is also the most important market for pork exports, though less so than beef. Exports were down in three of Canada’s top five pork markets in 2023, reflecting the pork production struggles at home and the global glut of pork.

Table 2: Top five pork export markets in 2023

Source: CIMT Database

Other trends to monitor in 2024

Live animal costs will be higher in 2024. The increase in hogs is marginal (0.8%), in chickens a little higher (2.1%), and in cattle the highest (6.8%).

Consumers want sales and promotions when purchasing meat. According to Nielsen, 34% of U.S. meat sales last year were made on promotion, up 4% from the previous year.

Regardless of meat type, convenience food sales will continue to grow as consumers seek ‘quick win’ meals. According to the 2022 Power of Meat Report, two-thirds of meat shoppers say they “sometimes” or “frequently” purchase value-added meat and poultry products, ranging from prepared kebabs to pre-formed hamburgers and pre-marinated chicken wings.