North American Meat Institute to Secretary Vilsack: Scapegoating Industry Does Not Help Consumer

The North American Meat Institute (Meat Institute) today said the Secretary of Agriculture’s transparent attempts to scapegoat the meat and poultry industry to shift blame for inflationary prices will not help consumers

“The Administration cannot ignore the fundamental principles of supply and demand,” said Meat Institute President and CEO Julie Anna Potts. “Americans are experiencing firsthand what the Secretary refuses to acknowledge, the effects of COVID and lack of labor are hurting consumers, and nothing proposed by the Secretary of Agriculture on the structure of the meat and poultry industry will help families struggling to pay for groceries.”

After repeated attempts to convey the challenges faced by meat and poultry packers and processors in meeting extraordinary consumer demand to Biden Administration officials, Potts sent the following letter, dated today, to Secretary Vilsack:

“Major US beef supply chain disruptions over the past two years have sent the cattle and beef industry into uncharted, but explainable territory“

Dear Mr. Secretary:

I write in response to your comments at the White House press briefing on Wednesday, September 8, 2021. I was surprised to hear you allege the structure of the meat and poultry industry is causing price inflation for meat and poultry products, and disappointed that you failed to acknowledge the array of market forces affecting retail prices.

The North American Meat Institute (NAMI or the Meat Institute) is the nation’s oldest and largest trade association representing packers and processors of beef, pork, lamb, veal, turkey, and processed meat products. NAMI members include more than 350 meat packing and processing companies, large and small, and account for more than 95 percent of the United States’ output of meat and poultry products.

The pandemic that began in 2020 and continues today may be the ultimate black swan event. But its occurrence does not automatically mean the system is broken or needs to be torn down and rebuilt. Nor does the fact that the industry has changed, and changed significantly over the past few decades, mean it has changed for the worse. The pandemic seems to be the vehicle spawning new bad ideas, and resurrecting other bad ideas, seemingly without recognizing economic realities and unintended consequences. Indeed, none of the proposals advanced at the press briefing will alleviate the consumer price increases the administration seeks to address.

At the press conference, you alleged industry structure caused retail price inflation for meat and poultry products. Yet in a recent report on food prices, the U.S. Department of Agriculture’s (USDA) Economic Research Service (ERS) examined beef, pork, and poultry prices, and never identified industry structure as a price driver.

Further, ERS identified economy-wide price inflation, confirming that consumer price inflation is far broader than meat and poultry products:

The all-items Consumer Price Index (CPI), a measure of economy-wide inflation, increased by 0.5 percent from June 2021 to July 2021 before seasonal adjustment, up 5.4 percent from July 2020. The CPI for all food increased 0.7 percent from June 2021 to July 2021, and food prices were 3.4 percent higher than in July 2020…

The CPI for “all-items,” which encompasses food, housing, transportation, and other categories, has increased 3.2 percent so far in 2021 compared to 2020. For context, annual all-items inflation has averaged 2.0 percent over the past 20 years. Inflation in 2021 is already over 50 percent higher than average annual inflation. Above-average inflation is expected to continue through 2022.

In a separate report on food prices and spending, ERS identified these causes of food inflation:

2020 was a year of high food price inflation due to shifts in consumption patterns and supply chain disruptions resulting from the coronavirus pandemic.

The most recent Producer Price Index News Release Summary from the U.S. Bureau of Economic Analysis shows that the inflationary trend in consumer spending continued.

July personal income and outlays reflected the continued economic recovery, reopening of establishments, and government response related to the COVID-19 pandemic. Government social benefits increased in July, reflecting new advance Child Tax Credit payments authorized by the American Rescue Plan.

Additionally, input costs rose for processors, as noted by the U.S. Bureau of Labor Statistics:

The indexes for natural gas, corn, wheat, slaughter steers and heifers, and corrugated recyclable paper also moved higher…

Over the past three months, Meat Institute staff have met with the White House Supply Chain Task Force, USDA’s Senior Advisor for Fair and Competitive Markets, and USDA’s Office of the Chief Economist. All were substantive discussions about the meat and poultry industry, but not once in any meeting did White House or USDA staff suggest consumer prices were rising because of industry structure. Similarly, prior to the press briefing, no White House or USDA staff contacted the regulated industry to raise concerns or discuss the issue. For an issue the White House deemed sufficiently significant to warrant discussion during an entire press briefing, somebody within the Biden administration should have engaged with the industry.

Finally, both the House and Senate Agriculture Committees held hearings last summer looking at cattle and beef markets, with agricultural economists testifying at both hearings. At neither hearing did any economist suggest that consumer price inflation for meat and poultry products was linked to the structure of the meat and poultry industry.

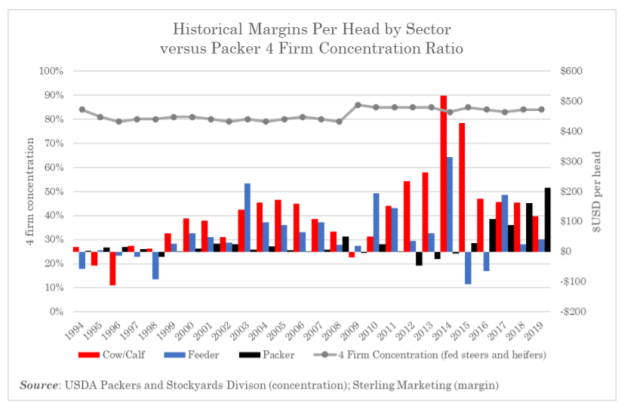

Given the misplaced allegations made at the press briefing, it is important to look at industry structure. The four-firm packer concentration ratios in beef and pork packing is monitored by the Packers and Stockyards Division (P&S) of the Agricultural Marketing Service (AMS). P&S data show the four-firm concentration ratio in fed cattle beef packing has not changed meaningfully in more than 25 years. As the chart, below, demonstrates, the four-firm concentration ratio has not precluded any sector of the beef industry – cow-calf producers, feedlots, or packers – from enjoying positive margins generally.

The chart demonstrates no sector – cow-calf, feedlot, or packer – had positive margins every year, and it highlights the fallacy that the four-firm concentration in the fed cattle industry precludes anyone other than packers from making money.

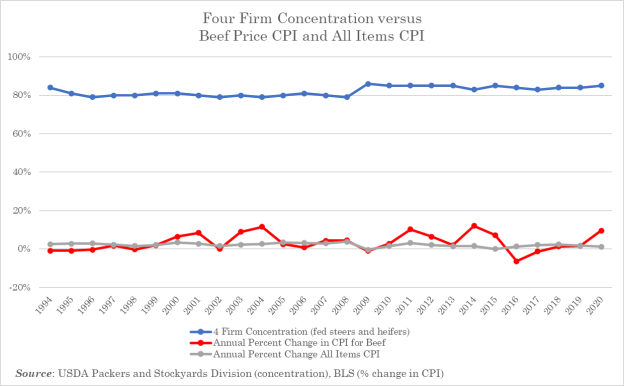

Contrary to the assertions in the press briefing, industry structure is not connected to inflation for meat and poultry products. Using the same P&S concentration data, the chart below demonstrates that, while the four-firm concentration in fed cattle beef packing has remained relatively constant since 1994, the CPI for beef has been variable over that same period; sometimes above and sometimes below the overall consumer price index. If concentration is causing the recent rise in consumer prices for meat and poultry products, why did concentration not cause inflation five or ten years ago?

Dr. Dustin Aherin, Vice President, RaboResearch Animal Protein Analyst, testifying at the House Agriculture Committee Livestock and Foreign Agriculture Subcommittee’s hearing in July, summarized the beef market through the pandemic:

Major US beef supply chain disruptions over the past two years have sent the cattle and beef industry into uncharted, but explainable territory. The imbalance of excess market-ready cattle supplies in the face of reduced operations packing capacity has put downward pressure on cattle prices. Meanwhile, consumer demand for beef and all animal proteins has reached record levels, fueled by pandemic stockpiling, increased and reallocated consumer income, and more recently, restaurant re-openings, not to mention export demand. These dynamics, combined with elevated processing costs, have increased the spread between beef price and cattle price, just as economic principles, past research, and historical market relationships would suggest. Both the direction and magnitude of the price spread are well within the range of expectation.

At the same hearing, Dr. Aherin also made a key point about inputs for beef production:

First, cattle are not beef. Cattle are one of several inputs into beef production. Other major inputs include labor, physical capital, and technology. These inputs are always seeking, but never finding, the perfect balance between one another. This creates cycles. Input imbalances are communicated through prices, whether that’s cattle prices, wages, or investments.

Production in meat packing and processing plants are tied to the number of employees working the line. Filling labor needs in meat and poultry plants was challenging before the pandemic, and has become acute today. The pace of Saturday shifts at meat plants has also strained available labor and has added to processing costs. Recent press stories report the industry’s recruitment efforts, including wage increases, signing bonuses, relocation bonuses, retention bonuses, and generous benefits. This labor shortage impact is not only on processing lines but also warehouse workers, maintenance positions, and other jobs critical to maintaining the supply chain.

The impacts of labor shortages and pandemic-related cost increases are hardly unique to meat and poultry: restaurants, healthcare, travel, transportation, manufacturing, and other sectors are feeling the pinch. Goods and services in a wide variety of sectors are increasingly scarce, and prices for consumers are rising. Unfortunately, at the press conference the challenge of labor shortages was never acknowledged. The Meat Institute will continue to work with our partners up and down the food value chain to address workforce issues.

Animal agriculture is the cornerstone of the U.S. agricultural economy: meat animals are the major “users” of forage, feed grains, as well as protein meal from oil seeds and even distillers’ grains co-produced at ethanol plants. The meat and poultry packing and processing industry has a significant downstream economic impact for most of U.S. agriculture.

Before the administration attempts to recreate the animal agriculture industry, it is prudent to look back and acknowledge the benefits that flow from the food supply chains as they exist, which ERS described as “efficient.” In 2020, according to ERS, Americans spent an average of 8.6 percent of their disposable personal incomes on food. Indeed, Americans spend less of their disposable personal income on food than any other country in the world. This remarkable drop is attributable largely to systematic efficiencies that allow food processors to offer food to consumers at lower prices.

These efficiencies yield other benefits, from improved sustainability to enhanced food safety. On July 19, NAMI and 11 other organizations representing farmers and companies who produce the vast majority of America’s meat, poultry, and dairy products, and animal feed and ingredients, unveiled the Protein PACT for the People, Animals, and Climate of Tomorrow. Protein PACT is the first joint initiative of its kind designed to accelerate momentum and verify progress toward global sustainable development goals across all animal protein sectors to ensure customers, consumers, and policy makers trust that meat aligns with their sustainability expectations.

Through the Protein PACT, Meat Institute members have developed robust metrics for continuous improvement and publicly committed to sustain healthy animals, thriving workers and communities, safe food, balanced diets, and the environment and align with the United Nations’ 2030 Sustainable Development Goals.

Respectfully submitted,

Julie Anna Potts

President & CEO

The North American Meat Institute is a leading voice for the meat and poultry industry.