Everything’s on the table: How COVID-19 Could Change Canada’s Meat Processing Industry

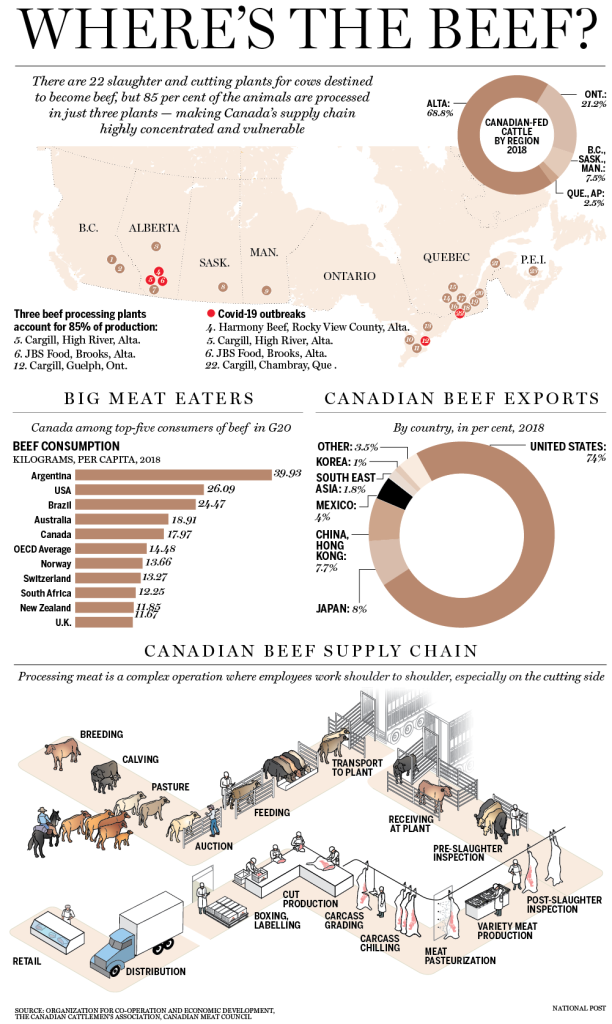

Outbreaks in big packing plants have been a painful lesson in the supply chain’s vulnerabilities, but solutions may be expensive for the industry and consumer

by Naomi Powell – Financial Post

“Big is bad.”

That’s the standard refrain Temple Grandin hears when she lectures students at Colorado State University on the complexities of meat processing plants.

Her standard retort: “Big isn’t bad. Badly managed is bad.”

For years, she has driven home this point: that even in a rapidly consolidating sector, where many small plants processing 500 head of cattle a day have been mothballed in favour of a few mega-facilities slaughtering 20,000 cows per day, high standards for animal safety and meat quality are still possible.

“The supply chain can handle one large plant being closed. But when it turns into multiple plants you have a problem”

“Those plants can do a good job,” the animal science professor and livestock handling expert said in an interview. “The size doesn’t matter very much that way.”

But it matters an awful lot in other ways. That became clear to Grandin a number of years ago, after massive floods crippled transportation in her home state of Colorado and an ice storm devastated Eastern Canada.

“Even then, I wasn’t thinking about a pandemic,” she said. “I was thinking more of things like power failures, power grids going down, massive storms taking out a single plant. The supply chain can handle one large plant being closed. But when it turns into multiple plants you have a problem.”

Big isn’t bad, Grandin decided. “Big is fragile.”

It’s a deeply painful lesson Canada’s meat industry has been forced to learn as COVID-19 sweeps through North America and into the handful of plants responsible for the bulk of the country’s meat processing.

Huge swaths of the workforce were infected in outbreaks at Cargill Inc.’s plant in High River, Alta., and JBS USA Holdings Inc.’s plant in Brooks, Alta., requiring entire operations to shut down. As the supply chain shuddered, multinationals Cargill and JBS — controlling 70 per cent of Canadian beef processing at those two Alberta plants alone — raced to stagger shifts, outfit staff in protective gear and retrofit facilities with plexiglass shields.

The question now is whether those measures will be enough to contain the virus or if a more fundamental reimagining of meat supply chains is necessary — one that would see more automation in processing, fewer cuts of beef in grocery store coolers, an unraveling of a decades-long shift to large scale production — and ultimately higher prices.

“Will the industry be changed by this? I think there’s no doubt about that,” said Mike von Massow, a food economist at the University of Guelph. “It’ll have to change to mitigate the spread of infection between employees which is something we’ve never had to think about before. Can we do it within the plants we have? I don’t think we know that yet.”

While beef farmers can slow the growth of cattle by manipulating feed, pigs grow until ultimately they’ve expanded beyond the plant’s ability to handle them – Scott Olson/Getty Images

At the core of the issue is a simple problem: COVID-19 thrives in crowds. And the quantity of workers inside each processing plant has only increased as production has become more concentrated. Indeed, just three plants — the JBS and Cargill High River facilities together with Cargill’s Guelph-based operation — now represent 85 per cent of all Canadian beef processing.

When large numbers of employees work closely together, the solution isn’t as simple as thinning shifts or telling staff working elbow to elbow to stand further apart.

A meat plant has two main parts. The “kill side” where the animal is slaughtered, bled and skinned and the “cut side” where its innards are removed and the meat is sliced, first into halves and then quarters. These “primal cuts” are then reduced into the smaller pieces seen in grocery stores — the steaks, roasts and ground beef bought in trays and boxes.

Three meat-packing plants turn out 85% of Canada’s beef. How did this happen?

‘Every Canadian is now watching Cargill:’ Meatpacking plant reopens today despite pleas from union

Canadians could face food shortages, higher prices this summer amid turmoil in supply chain

Over the years, the industry has gotten better at directing specific cuts to individual markets. Indeed, Canada exports 44 per cent of its beef, mostly to the United States but also to Asian countries where parts considered waste in North America — kidneys, hearts, tongues and tripe — draw a good price.But producing all those cuts requires the kind of human skill that meat processors have struggled to replace.

“The part that has the most people is the cut up,” said Grandin, who was the subject of a Hollywood movie, starring Claire Danes, highlighting her work as an animal scientist. “On the slaughter side, the people are much further apart and it’s easier to pull them apart, but on the cut-up side they’re shoulder to shoulder.”

Early infection control measures included reducing the number of people on each shift. But while that might slow the spread of the virus, it also slowed down “the line,” — the continuous, largely linear flow of a meatpacking plant that sees live animals arrive at one door and finished products emerge from another. With fewer people on “the cut,” the backlog of animals ready for processing swelled, leaving farmers to house and feed them for longer than intended.

That has both hiked costs for farmers and escalated the risk of the animal growing too big to be processed in the plant, where it spends much of its time hanging from an overhead chain that can only handle so much weight — a particularly vexing problem for pork farmers. Indeed, while beef farmers can slow the growth of cattle by manipulating feed, pigs grow until ultimately they’ve expanded beyond the plant’s ability to handle them.

“A normal weight for a pig to be processed is 280 pounds,” said Grandin. “Let’s say I have a 370-pound pig. I can’t put them on every hook in the plant, I’ll break the chain if I do that and shut the plant down half a day. But if I put a pig on every other hook, now I’ve cut the processing speed in half.”

Automation may provide opportunities to reduce the ranks of workers and slow the spread of infection. Indeed, robotic handling has done much to quicken operations in other areas of processing plants and the industry has been exploring its use for cutting operations. But here again, there are challenges.

Cattle are less genetically homogeneous than lamb or chickens, said Dave Moss, general manager of the Canadian Cattlemen’s Association. That means the pieces moving along a conveyor belt are rarely the same size or shape.

For robotic machines built for uniformity, that randomness has been difficult to overcome.

“It’s easy to automate something if the thing you are handling is always in the same position,” said Grandin. “But on the cut side, the meat’s not going to come down that conveyor always in the same position. You need people.”

What about reducing the number of cuts and therefore the number of people required to produce them? Could we all learn to take a quarter of an animal and butcher it at home?

That would mean eliminating many cuts popular in other countries, eating into our export opportunities, noted Kim O’Neil, director of beef and veal at the Canadian Meat Council.

It also might not be terribly appealing to Canadians, who lack the fridge and freezer space necessary to handle large cuts of meat.

“We are seeing a lot of groups trying to educate the public on how to cook different cuts,” she said. “But a lot of what we export, Canadians simply don’t eat.”

That leads to the question of whether safeguarding the supply chain might require a more radical solution. A more distributed model, one with smaller plants, would see production spread out over more facilities rather than concentrated in just a few. That way if one plant is wiped out by infection, more would be available to backfill demand.

“It’s a valid question, I just don’t know if it’s the answer,” said von Massow.

The issue of infections, he notes, has less to do with the size of the plant and more to do with the structure of the process within it, one that relies on many workers pushed in together. Indeed, smaller plants are only valuable if they are built in a way that spaces people further apart.

“Most of the existing ones are built in the same way as the larger facilities,” he said.

Building a new meat processing plant from the ground up — one designed with infection control in mind — could cost between $300 and $400 million depending on design, said Moss. What’s more, it’s not clear that controlling the spread of infection depends entirely on what happens on the plant floor.

“The challenge is that social distancing has to happen before and after work and while you can control conditions at work, you can’t control it when people go home,” said Moss.

In addition to investing in temperature testing, cleaning and sanitizing procedures and personal protective equipment like gloves and masks, companies such as Cargill have produced educational materials for workers, translating them into up to 40 languages for temporary foreign workers.

Though the plants are currently focused on bringing existing operations back online, “everything is on the table” when it comes to the future, including a reorganization of supply chains, said Chris White, president of the Canadian Meat Council.

“There is an awareness that what plants looked like pre-COVID isn’t what they will look like when this is over,” said White, whose organization represents all of the country’s major processors, including Cargill and JBS. “There will be a lot of discussions about automation, about whether other major changes are needed. There will be a whole-of-industry approach. But for the moment, people are just trying to get through right now.”

While any solution will cost money, a reimagined supply chain of smaller plants undoubtedly carries the highest price tag of all, Grandin notes.

“How do you process in smaller plants for the same price? You can’t,” she said. “The problem is big plants have economy of scale. Fixed costs such as buildings, water, electricity, they go down. Your cost per pig, per cow goes down. A more distributed supply chain will be more expensive. This is the trade off and there’s no way to change this. ”

Originally published in the Financial Post