Feed Barley Pricing Pulls Back From Summer Highs

The marketing season transitioned from old to now new crop at the beginning of August, and a couple of weeks ago, PFCanada wrapped up old crop marketing of 2016 production feed barley

by Farm Credit Canada (FCC)

It was a housekeeping exercise which just happened to coincide with the best old crop pricing opportunity of the past year.

Season’s peak

Prairie cash barley prices steadied in late May and turned higher into July, with Lethbridge area cattle feeders bid as high as $220 per tonne ($4.80 per bushel) for the season’s peak so far. Rising prices adjusted to reflect dry conditions in Saskatchewan and Alberta. Drought in North Dakota and Montana compounded the issue.However, prices backtracked over the past two weeks with Lethbridge feeders bidding around $197 per tonne ($4.30 per bushel) for nearby delivery. September delivered bids inched up to start this week to about $202 per tonne. New crop delivered bids in Alberta’s feedlot alley (October to December) remain firm around $214 per tonne.

“The barley market needs to ration demand with new crop 2017-2018 ending stocks now projected to potentially decline below one million tonnes”

Locked bins

Reduced seeded acreage to barley in 2017, combined with recent hot, dry weather, resulted in locked bins this summer at a time when prices typically ease from seasonal highs ahead of new crop availability. But farmer selling has picked up lately. Also, it seems that vomitoxin levels are less of a concern than earlier in the year. There is no longer a notable premium on a maximum one part per million vomitoxin barley.In Saskatchewan, we also saw quite a leap in feed barley pricing, with values reaching as high as $3.55 per bushel picked up on the farm earlier in July. Those prices ticked back $3.25 per bushel. Movement seems to be pushed back to an August-September timeline, but these prices are still an improvement from $3 per bushel or less seen in the late spring.

Tightened fundamental structure forecasted

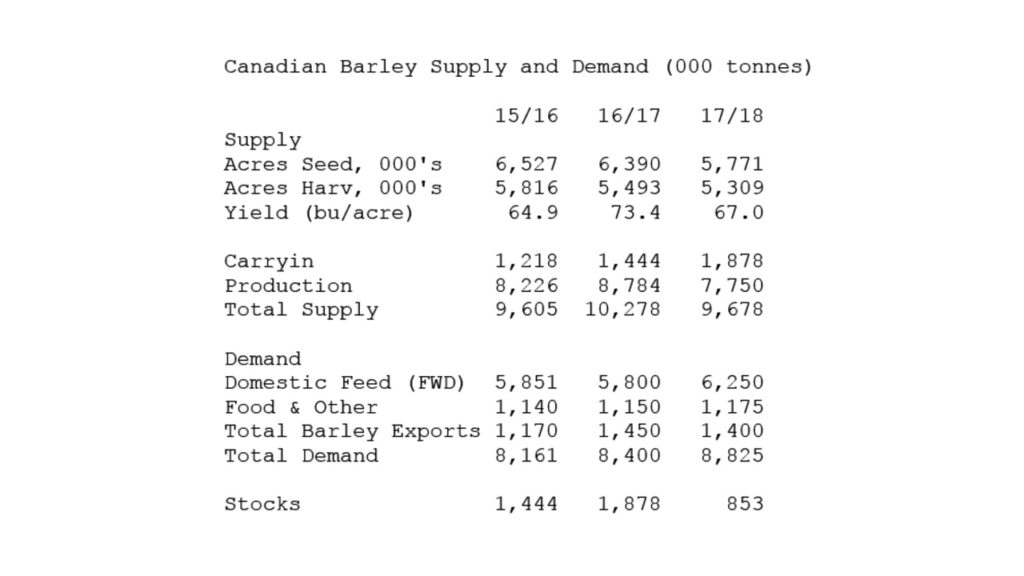

PFCanada continues to forecast a tightening fundamental structure for the 2017-2018 marketing year, therefore still holding off on initiating new crop forward contracting now, though that opinion could change at any time.In late June, Statistics Canada reported that acres seeded to barley fell by 9.7 per cent to 5.8 million acres, which is the smallest Canadian barley acreage in more than 50 years. We currently estimate Canadian barley production at 7.8 million tonnes, down from the 2016 crop of 8.8 million tonnes.

The barley market needs to ration demand with new crop 2017-2018 ending stocks now projected to decline below one million tonnes, down from the 1.9 million tonnes expected for the current old crop marketing year, which ended on July 31.

Bottom line

Ultimately, pricing within Western Canada’s feed grain market may rise to a level which draws increased imports of American corn and/or dried distillers grains as cattle feeders look for alternative feed sources. At this time, I’m not sure where that line is drawn, but Canfax’s Weekly Feeder Summary points to Western Canada potentially losing its feed cost advantage over the United States.New crop barley will come on to the market as early as August, a time when cattle-on-feed inventories dip to seasonal lows.

Courtesy of Farm Credit Canada (FCC)